Stake, Chill, Earn: Secure the Network and Grow Your SOMI Bag

Holding SOMI is good. Staking is even better.

Now you can stake your SOMI tokens and track your yield in the new Somnia staking dashboard. The dashboard gives token holders clarity on how much they can potentially earn by staking their tokens and shows exactly where those rewards are coming from.

Staking is about more than just earning yield. It is central to how Somnia remains secure, decentralized, and sustainable. Validators stake SOMI to participate in consensus, and delegated stakers strengthen the system by backing them. This ensures the network is reliable even as usage scales to high levels.

Stake With Somnia

If you haven't noticed yet, Somnia does things differently, rethinking every aspect of the design process to push the industry forward. Our approach to staking is also unique, because the APR is not fixed like it is on many other chains, it fluctuates based on how much the network is being used, making it more sustainable.

For example, during a period of high activity such as a major game launch or a spike in onchain trading, more gas fees are generated. This increases both the burn rate and the staking APR, which flows directly to SOMI holders and stakers. In quiet periods, the yield adjusts downward to reflect actual usage.

On blockchains with a fixed APR, staking rewards are usually funded by printing new tokens, but the SOMI token has a fixed supply with deflationary mechanics, with the yield coming from the transaction fees.

For purposes of staking yield, network usage is measured by gas fees paid by applications and users. These fees are split evenly:

50% are burned, reducing the total supply of SOMI.

50% are distributed to validators and delegated stakers.

This means there are two measurable components of yield:

Burn Rate - The projected percentage of total supply burned over a year, based on current usage.

Staking APR - The share of gas fees distributed to validators and stakers, divided by the total tokens staked.

Together, these two figures create what Somnia calls Real Yield.

By holding SOMI, you capture the burn rate.

By staking SOMI, you capture both the burn rate and the staking APR.

This system is dynamic. The more the network is used, the higher both the burn rate and staking APR will go. To ensure transparency, these figures are calculated on a rolling basis from the last 100 epochs and updated every five minutes on the staking dashboard.

How to Stake

In the Somnia Browser you’ll see a tab for Staking, when you click on that tab, you’ll be taken to the staking dashboard.

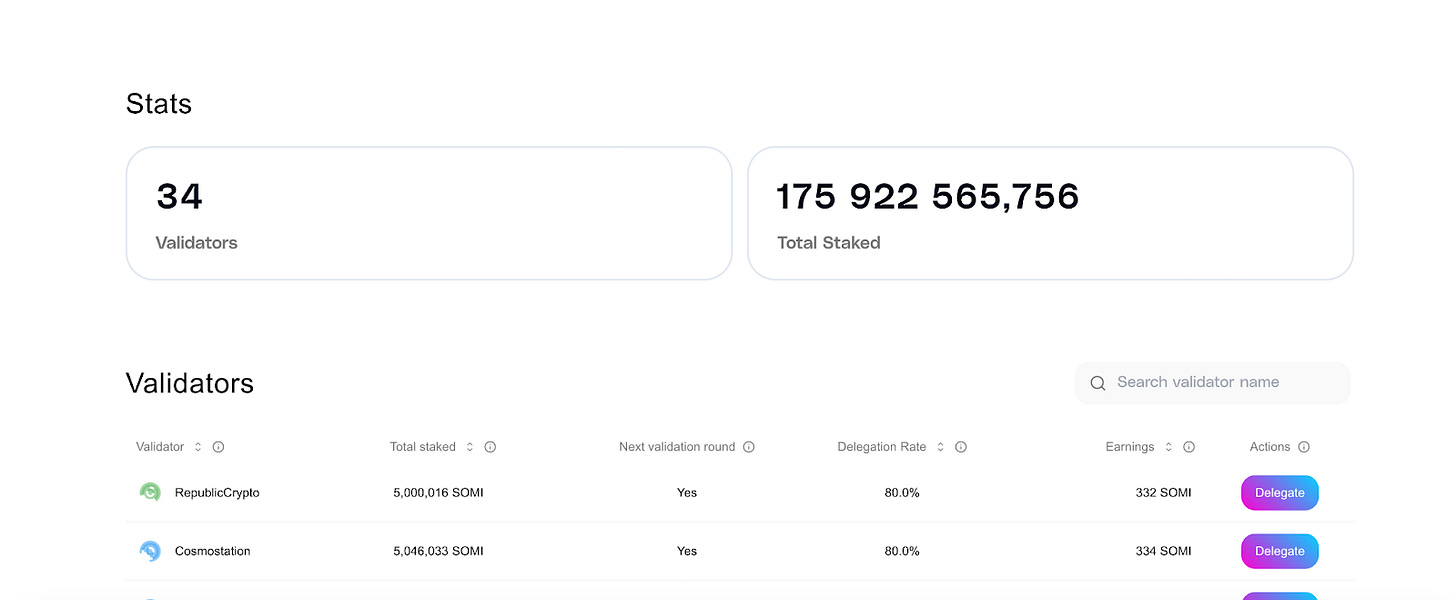

Once on the staking dashboard, you’ll be able to see how many validators are active globally, and how much SOMI is currently being staked across the network. You’ll also be able to browse through the different validators to see how much is being staked with them and what their delegation rates and earnings are.

You can use the purple “Delegate” buttons on the right side of the screen to make your delegations, but you should think carefully about this decision, because selecting validators comes with strategic and game-theory considerations.

Validators with a large amount of SOMI staked are generally seen as the safest option since they already have strong backing and a proven track record. The tradeoff is that rewards are spread across more stakers, which dilutes the return for each delegator.

Smaller validators, on the other hand, may offer higher rewards per token because fewer people are sharing the fees, but they can also carry more risk if they have lower uptime or less infrastructure in place. These are the factors that you should consider when deciding where to stake your tokens.

Start Staking!

Over a long time horizon, stakers typically do way better than traders in crypto markets, but staking isn’t just a way to earn yield, it’s also how you support the decentralization and long-term strength of the Somnia network. Every token staked contributes to security, stability, and reliability, ensuring the network can scale as more applications and users come online.

Delegated stakers play a vital role by backing validators and broadening the base of participation. This keeps Somnia from becoming overly reliant on a small set of operators and helps preserve the open, distributed design of the chain. By committing tokens for the long term, you’re helping build the foundation of an ecosystem designed to last, while benefiting from the real yield that grows with adoption. The staking pools that are currently open are liquid, meaning anything that you delegate can be reclaimed any time you wish. In the future, different types of pools with different features and lock times will be available.

Staking is perfect for Somniacs that believe in Somnia’s long-term vision and plan on holding as the network grows.

…If that’s you, take a look around the staking dashboard and make your delegation!