How to Provide Liquidity on Somnex to Earn Rewards

The Somnia Liquidity Points program continues to reward Somniacs who contribute to the ecosystem’s growth, and one of the best ways to earn is by providing liquidity on Somnex. Somnex offers multiple strategies for liquidity provision, each designed for different risk appetites and goals. Here we explain each of those strategies.

Getting Started: Three Liquidity Strategies

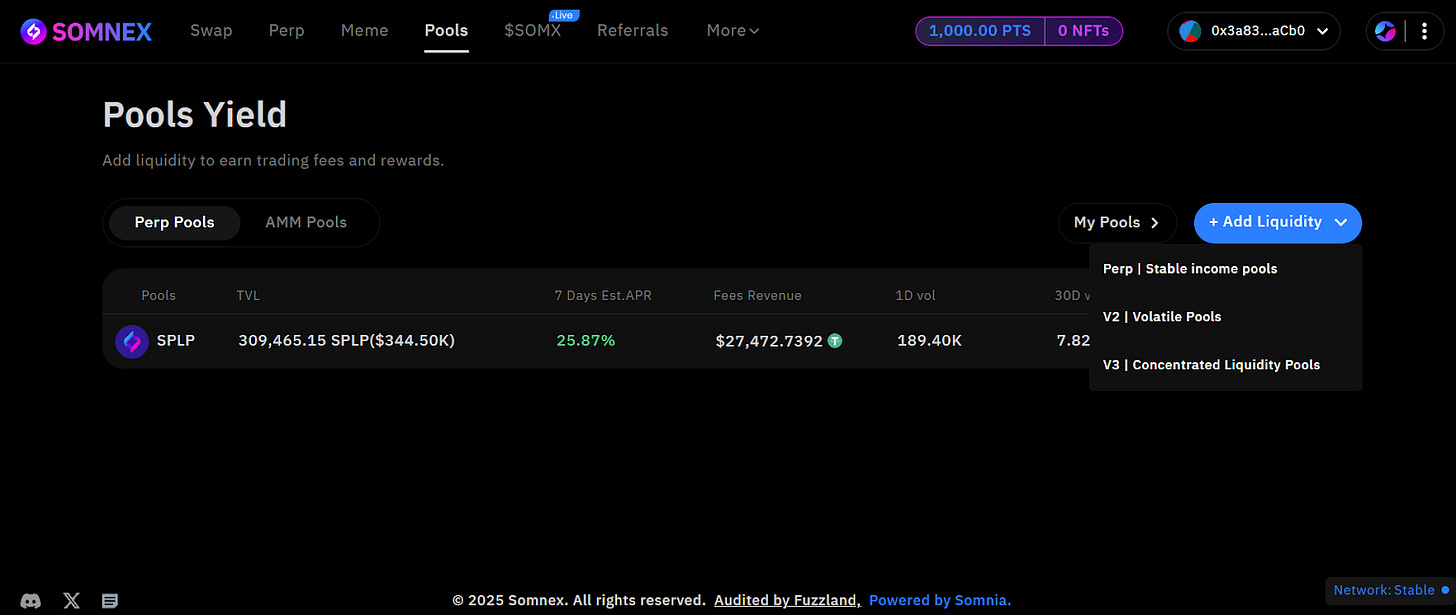

To add liquidity, navigate to “Pools” and select “Add Liquidity,” then choose the strategy that aligns with your goals.

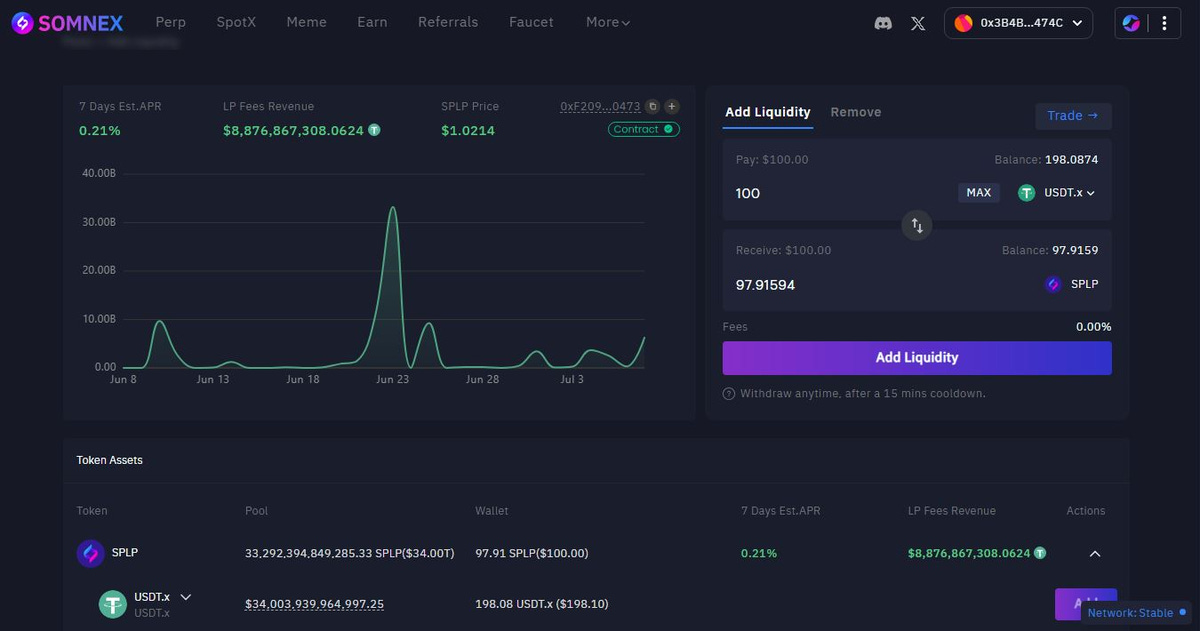

Perp Pools: Stable Income with SPLP

For users seeking consistent, low-risk returns, Perp Pools offer an attractive option. This strategy is designed for low-risk exposure with USDC in and USDC out. You’ll make single-sided deposits without needing to pair tokens, and there are no locks, so you can deposit and withdraw anytime. The platform distributes yield in real-time with no claims required and no extra fees. Your rewards come directly from perpetual trading fees, making this ideal for users seeking passive income without worrying about impermanent loss.

Here’s how to add liquidity to Perp Pools:

Select “Perp Pools” and deposit USDC

Review the projected APR, which is driven by trading fees

Approve and confirm your deposit

Monitor utilization and APR, and withdraw anytime according to pool rules

This strategy works well if you want to earn Liquidity Points while maintaining stable value exposure.

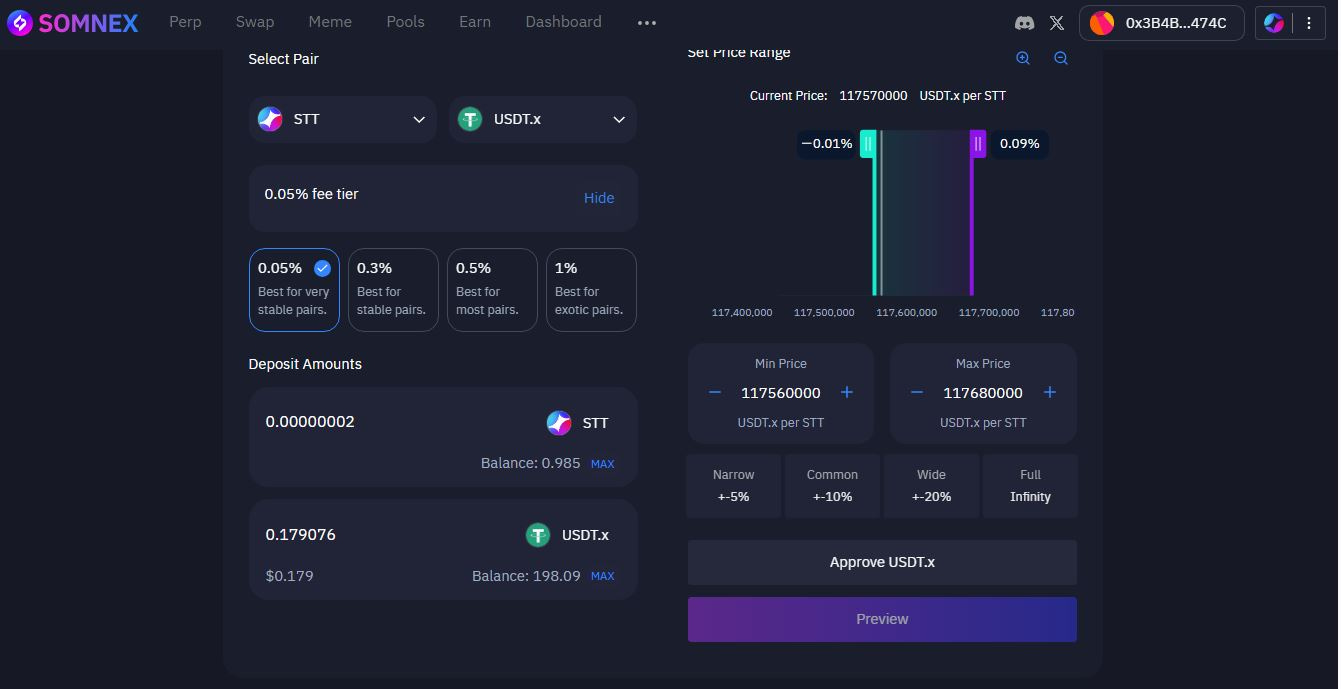

V3 Pools: Concentrated Liquidity for Advanced LPs

V3 Pools allow you to maximize capital efficiency by concentrating liquidity within specific price ranges. These pools let you deploy liquidity within custom price ranges, optimizing fee capture relative to price movement. You can choose from selectable fee tiers ranging from 0.05% to 1% depending on pair volatility, and set custom price ranges via tick-based boundaries for capital-efficient LP provisioning. This approach is ideal for advanced LPs who want to maximize returns through strategic price range selection and are comfortable actively managing positions.

Here’s how to add liquidity to V3 Pools:

Choose your pair and fee tier, then set a price range

Add token amounts, ensuring both sides match the required ratio

Approve and confirm your position

Re-range as needed to keep your liquidity active as prices move

V3 positions can generate higher fee income per dollar deployed, but they require more active management to maintain efficiency as prices move.

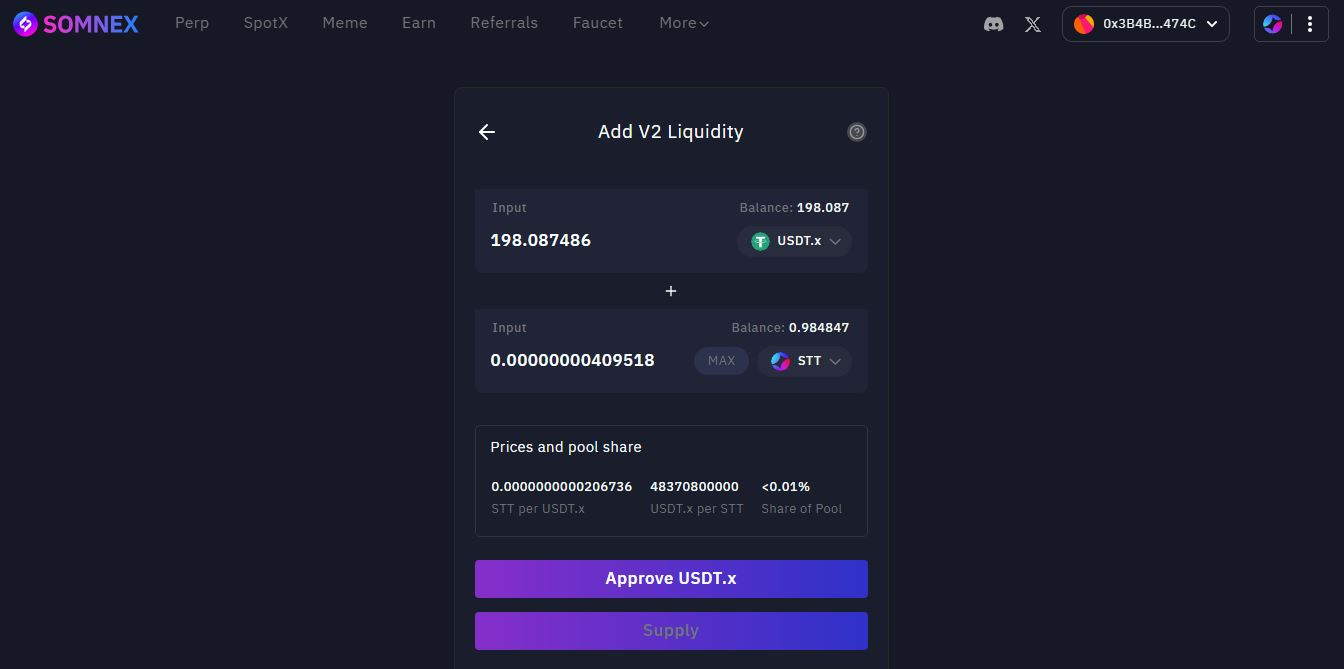

V2 Pools: Volatile Exposure for Long-Term Holders

V2 Pools offer a straightforward approach to liquidity provision across the full price spectrum. Yield potential increases with volatility, and they’re easy to manage since there’s no need to set custom ranges. This option is best for users comfortable with market risk and aiming for long-term gains.

Here’s how to add liquidity to V2 Pools:

Choose your pair and deposit both tokens at a 50/50 value split unless otherwise specified

Approve and confirm your deposit

Earn swap fees continuously from that point forward

V2 pools are particularly useful for newer tokens in the Somnia ecosystem and for LPs who prefer a set-it-and-forget-it approach.

Start Earning Today

Each of these strategies contributes to your Liquidity Points accumulation. The program tracks your provided liquidity over time, rewarding sustained participation in the ecosystem. With Somnia’s sub-cent transaction fees and sub-second finality, managing your positions remains affordable and responsive.

Providing liquidity on Somnex, Quickswap, Somnia Exchange or Tokos is one of the most direct ways to participate in Somnia’s growth while earning both trading fees and Liquidity Points.