Getting Started With Tokos: Somnia’s Native Lending Platform

Tokos, Somnia’s native lending platform, brings decentralized lending and borrowing to the network, allowing anyone to earn yield on their assets or access liquidity without relying on banks or centralized intermediaries.

Tokos is designed to feel familiar to anyone who has used Aave or other major DeFi protocols, but it comes with the added advantage of Somnia’s performance. With over 1 million transactions per second, sub-second finality, and sub-cent fees, Tokos brings a level of scalability and efficiency that most lending platforms can’t match. This combination of proven mechanics and high-performance infrastructure creates a foundation for DeFi on Somnia that is both accessible and resilient.

What is Tokos?

Tokos is a non-custodial liquidity protocol that allows users to supply assets to earn yield and borrow assets against their collateral. Everything is managed through smart contracts deployed on Somnia, with no centralized parties controlling the funds. Users interact directly with pools of liquidity, which are constantly balanced by supply and borrow activity.

Assets supplied to the platform are deposited into liquidity pools and borrowers draw from those pools by locking up their own assets as collateral. Interest paid by borrowers is distributed to suppliers, creating a self-sustaining system where incentives align naturally.

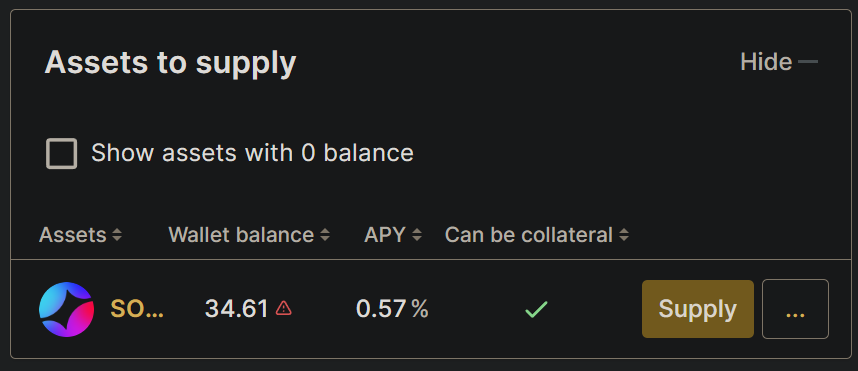

Supplying: Earn and Collateralize

Supplying assets to Tokos allows users to earn interest while strengthening the overall liquidity available for other users. Each time you supply, Tokos mints you a corresponding amount of ArTokens. These tokens represent your share in the pool and automatically accrue yield over time.

Supplied tokens can also be marked as collateral. By enabling collateral, you unlock the ability to borrow against your deposits, effectively using your assets as working capital instead of letting them sit idle.

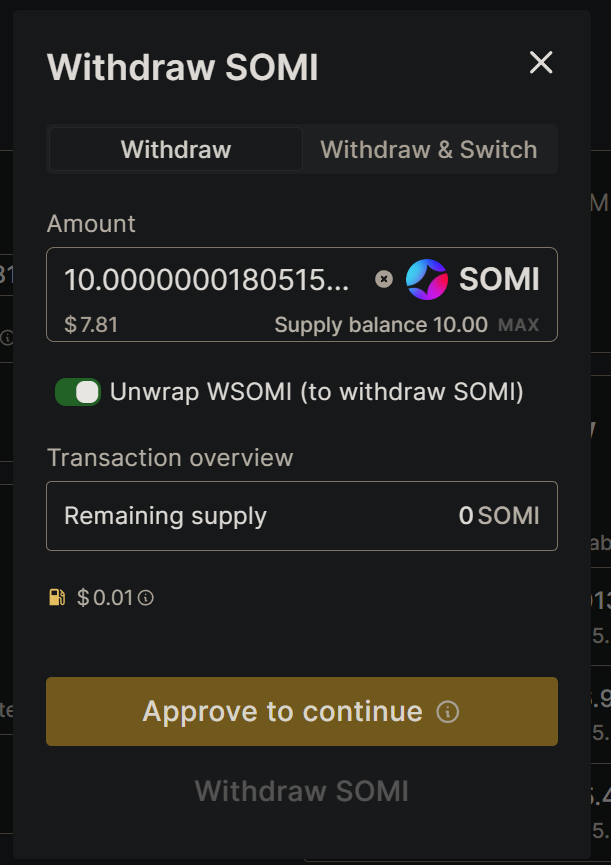

Withdrawing is straightforward. You redeem your ArTokens for the underlying asset, plus any interest earned. Withdrawals are subject to available liquidity, and if your tokens are being used as collateral for an active loan, you’ll need to repay or adjust your borrow position before withdrawing.

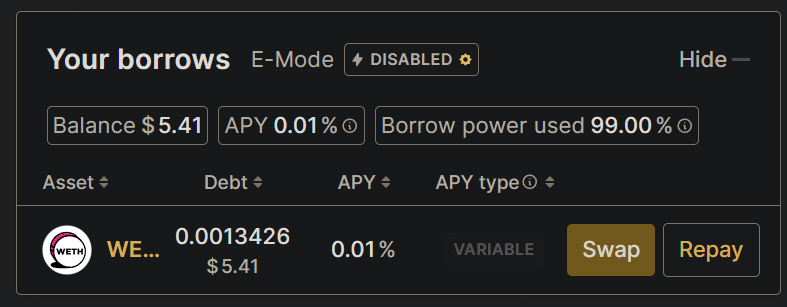

Borrowing: Manage Exposure

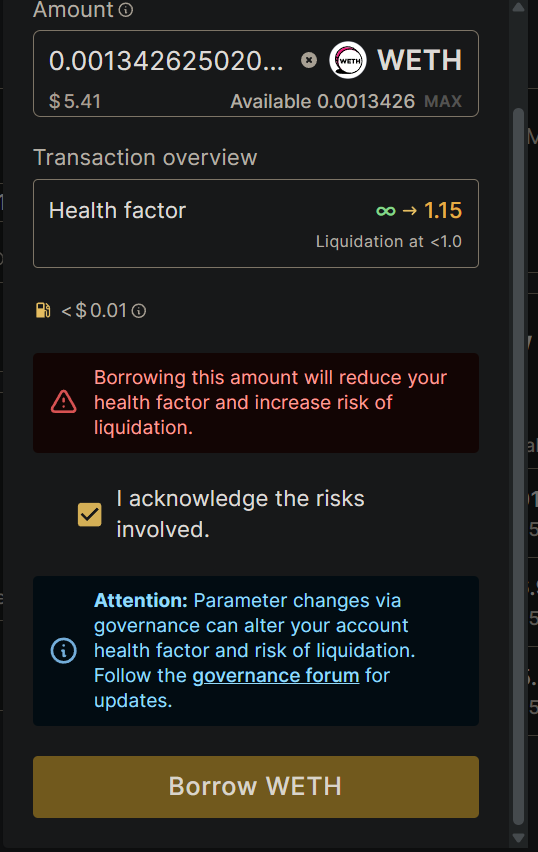

Borrowing on Tokos follows the principle of over-collateralization. This means you must always deposit more value as collateral than the amount you want to borrow. The protocol enforces this balance using a metric called the Health Factor.

The Health Factor is a real-time measure of how safe your position is. If it remains above 1, your position is healthy. If it falls below 1, your collateral becomes eligible for liquidation. Market prices, supplied collateral, and accrued interest all affect this number.

Loans don’t have fixed terms. As long as you maintain sufficient collateral, your borrow position can remain open indefinitely. This flexibility makes Tokos useful for many strategies. Traders can borrow assets to pursue market opportunities, while long-term holders can unlock liquidity without selling their positions.

Step-by-Step: Using Tokos

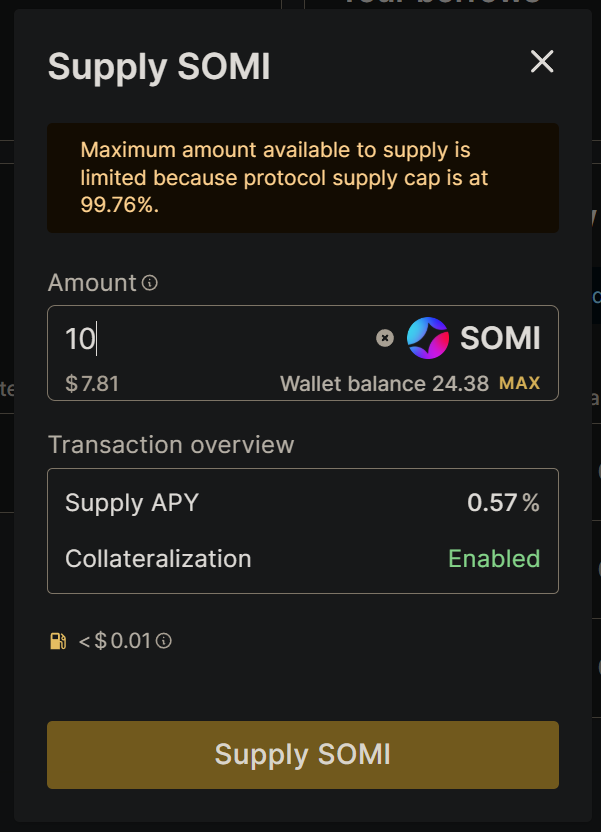

Supplying Assets

Connect your wallet

Choose the asset you want to supply.

Enter the amount and approve the transaction.

Receive tokens in your wallet representing your position.

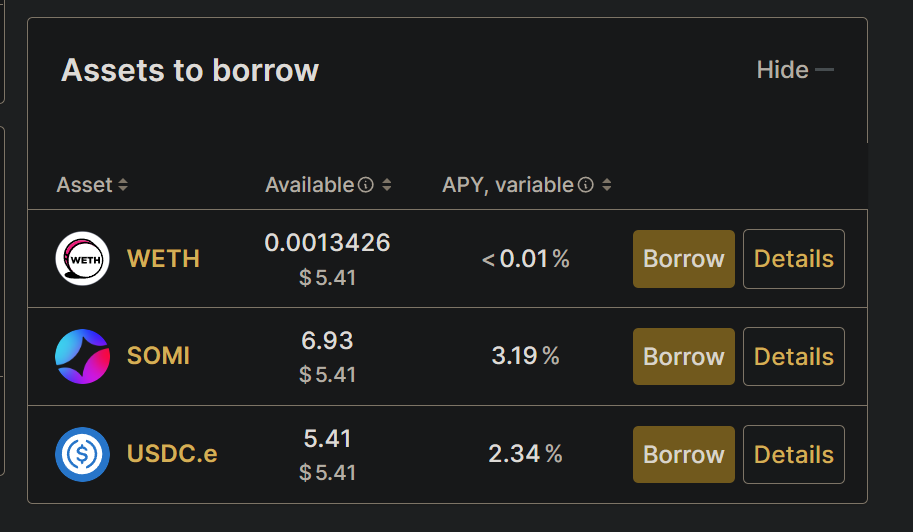

Borrowing Assets

Supply and enable collateral. (see previous step)

Select the token you’d like to borrow.

Enter the borrow amount, checking your Health Factor before confirming.

Approve the transaction and receive the borrowed tokens.

Withdrawing or Repaying

Withdraw by redeeming ArTokens for the underlying asset.

Repay borrowed tokens plus interest at any time to close or reduce your debt position.

Advanced Features for Power Users

Tokos also supports more advanced risk management and efficiency tools:

Efficiency Mode (E-Mode): Enables higher loan-to-value ratios for correlated assets like stablecoins. This makes it easier to run strategies that rely on swapping between assets of similar risk profiles.

Isolation Mode: New or volatile assets can be safely added as collateral while limiting their borrowing power to stablecoins. This allows innovation without introducing systemic risk.

Siloed Borrowing: High-volatility assets can be placed in isolated borrowing conditions, reducing exposure while still allowing them to participate in the market.

These features allow Tokos to evolve and scale responsibly as more assets are added to the platform.

The Somnia Advantage

On many blockchains, lending platforms slow down or become expensive to use during times of high demand. This can cause delays in liquidations or prevent users from making adjustments to their positions when they need to most.

Tokos doesn’t have these limitations. Somnia’s throughput ensures that transactions remain fast and affordable, even during market volatility. This stability makes liquidations fairer, risk management more reliable, and everyday interactions more predictable.

Tokos is also positioned to integrate with Somnia’s broader ecosystem. Imagine supplying tokens and earning yield, then using those same assets as collateral to borrow stablecoins for in-game purchases. Or borrowing tokens to participate in gaming prediction markets without selling long-term holdings. These are just a few of the ways Tokos can plug into Somnia’s gaming, social, and DeFi applications.

By providing reliable, scalable liquidity markets, Tokos supports the growth of new applications in gaming, entertainment, and beyond.

Getting Started

Tokos is now live on Somnia Mainnet. Whether you want to earn interest on idle assets, borrow liquidity to increase exposure, or explore new financial strategies in the Somnia ecosystem, Tokos makes it possible.