Explaining SOMI Tokenomics: A Model for Long-Term Sustainability

Now that you’ve met SOMI, the native token of the Somnia blockchain, it’s time to take a closer look at how it works. A healthy blockchain isn’t just about performance metrics, the tokenomics and economy are also incredibly important to the long-term sustainability of any blockchain network.

For Somnia, the focus has always been on creating incentives that reward real contributors and benefit the ecosystem. This is why Somnia’s tokenomics are designed to balance stability, validator security, community participation, and ecosystem growth.

Token Utilities

Every transaction on the network will be paid using the SOMI token. Validators are required to stake 5,000,000 SOMI to run a node, a threshold that ensures they remain committed and well-resourced. Those who do not operate validators directly can still get involved and collect rewards by delegating their SOMI to active validators.

Over time, SOMI will also become the foundation of governance, giving holders the ability to help shape upgrades, policies, and the long-term direction of the chain.

Staking

Staking on Somnia is designed to reward performance and accountability. Validators must meet hardware standards to keep pace with Somnia’s high throughput. In the event that a validator fails to meet the minimum staking requirements, a cooldown period will be provided to the validator to fulfill the staking obligations, typically lasting for one month.

Two forms of delegation give flexibility to Token Holders:

- Validator-specific delegation: Token Holders can back individual validators, sharing in their rewards. When providing their Tokens to Validators, Token Holders must wait 28 days before unstaking. Emergency unstaking is possible, but at the cost of 50% of the locked Tokens, which are redirected back to the Treasury.

- General pool delegation: Token Holders can delegate into a pooled system that automatically distributes SOMI across multiple validators. This lowers risk but provides slightly lower returns. Unlike validator-specific staking, the general pool has no lock period, giving delegators more liquidity.

Sustainable Gas Economics

Gas fees play a central role in keeping a blockchain both usable and secure. If fees are too high, users will be priced out, and if they’re too low, spam and malicious activity can overwhelm the chain. Somnia’s gas model is designed to strike the right balance of affordable, predictable, and scalable.

The structure is based on Ethereum’s familiar formula of “Gas = Usage × Price,” making it easy for developers to work with. To encourage growth, Somnia introduces volume-based discounts that can lower effective gas costs by as much as 90 percent as applications scale. The system also uses dynamic pricing that adjusts automatically with transaction load and block execution time, ensuring that the network continues to run efficiently during both periods of low demand and spikes in activity.

A Fixed Supply and Deflationary Model

SOMI has a capped supply of 1,000,000,000 Tokens. The fixed supply is designed to create predictability and protect long-term holders. In many networks, validator rewards are funded through constant inflation, with new Tokens minted every block. That approach can keep validators incentivized, but over time it dilutes existing holders and creates downward pressure on price, especially if demand doesn’t keep up.

Somnia avoids this cycle by replacing endless inflation with a balanced model. Validators are rewarded through a treasury allocation, and 50% of all gas fees are also paid to the validators. This ensures that long-term rewards are clear and predictable without minting new Tokens into existence. At the same time, the remaining 50% of all gas fees are burned, meaning that as activity on the network increases, the circulating supply steadily decreases. This approach balances sustainability and security. Validators are rewarded, but without relying on endless inflation.Subscribed

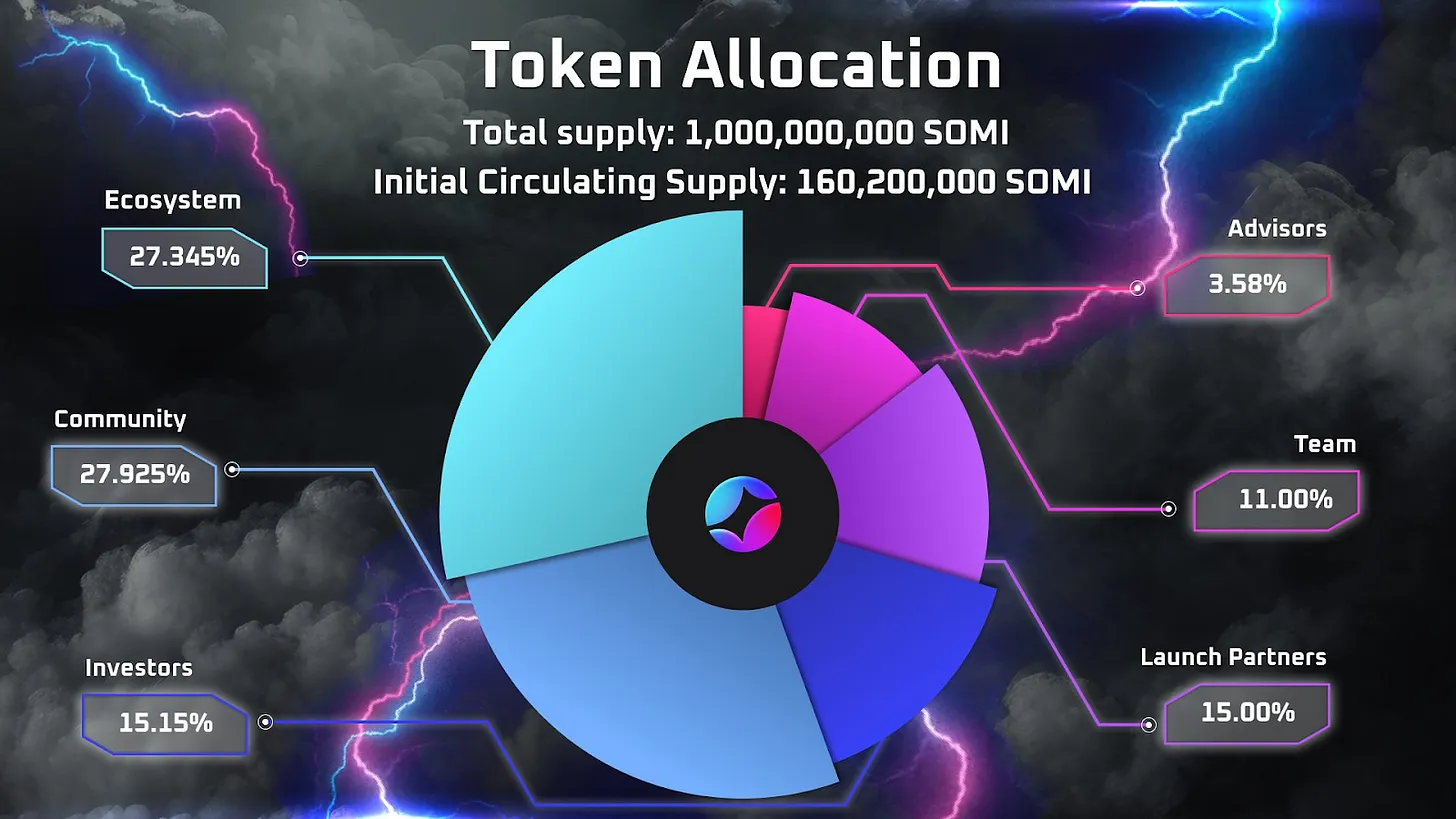

Token Allocations

The 1,000,000,000 SOMI supply is distributed in a way that prioritizes community and ecosystem growth while keeping long-term contributors aligned:

- Community (27.925%): Airdrops, quests, validators, and other rewards that directly involve users.

- Ecosystem (27.345%): Grants, partnerships, liquidity, and funding for builders.

- Team (11%): Reserved for the team and founders who built the project, vesting over 48 months, with a 12 month cliff.

- Launch Partners (15%): Early ecosystem contributors, vesting over 48 months with a 12 month cliff.

- Investors (15.15%): Aligned long-term supporters, vesting over 36 months with a 12 month cliff.

- Advisors (3.58%): Strategic contributors guiding Somnia’s growth, vesting over 36 months with a 12 month cliff.

This structure makes the community and ecosystem the largest beneficiaries, with over half the supply dedicated to direct participation and development. This group will also be able to unlock 100% of their Tokens much earlier than the others. Meanwhile, there are extensive cliffs and vesting schedules for investors and team members that last between 1 and 4 years.

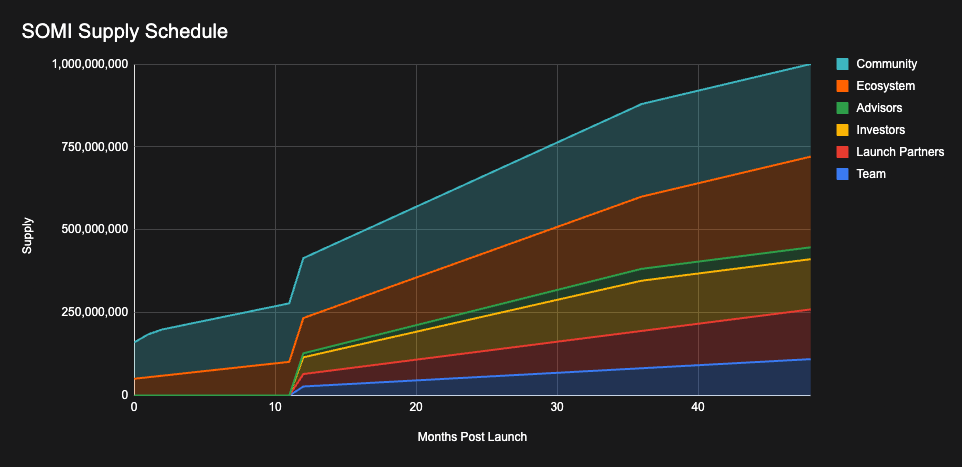

Unlock Schedule

SOMI’s unlocks are spread over 48 months, with each allocation being released gradually, and the community being first in line to receive their full allocations. The gradual release of Tokens prevents sudden shocks to supply and ensures steady and predictable growth. Here’s a quick breakdown of the unlock schedule:

- Initial Airdrop Tokens are fully unlocked after 60 days, with gradual unlocks on a weekly basis. Quills, Somniyaps and Discord roles will unlock immediately.

- Community Incentives supporting liquidity and rewarding contributors will gradually roll out in stages after launch.

- Ecosystem Tokens are distributed steadily to fund growth initiatives and partnerships.

- Partners, and Investors face 12-month cliffs before their Tokens vest, ensuring alignment with Somnia’s success.

- Team Members have a vesting schedule of up to 4 years.

This pacing creates a sustainable growth curve where circulating supply expands alongside actual network adoption.

Built to Last

Everything about this tokenomics framework has been meticulously designed with the intention of creating a sustainable ecosystem that can last forever. The fixed supply and burn mechanics prevent endless dilution, staking and delegation keep validators accountable while opening rewards to the wider community, and the gas model ensures the network stays affordable without sacrificing security. On top of that, the allocation and unlock schedules are structured to give the community and builders early access while keeping the team, partners, and investors committed over several years, staying with Somnia.

If you want to dig deeper into Somnia’s tokenomics and economic design, check out the full report HERE.